In real estate investing, cash flow isn’t just a number; it’s the heartbeat of success. If you don’t know how to measure it, you’ll never know if your property is working for you or against you.

Understanding cash flow means understanding how money flows into your business, where it leaks out, and how to maximize what stays in your pocket. That’s where a rental property cash flow analysis comes in; it turns guesswork into clarity.

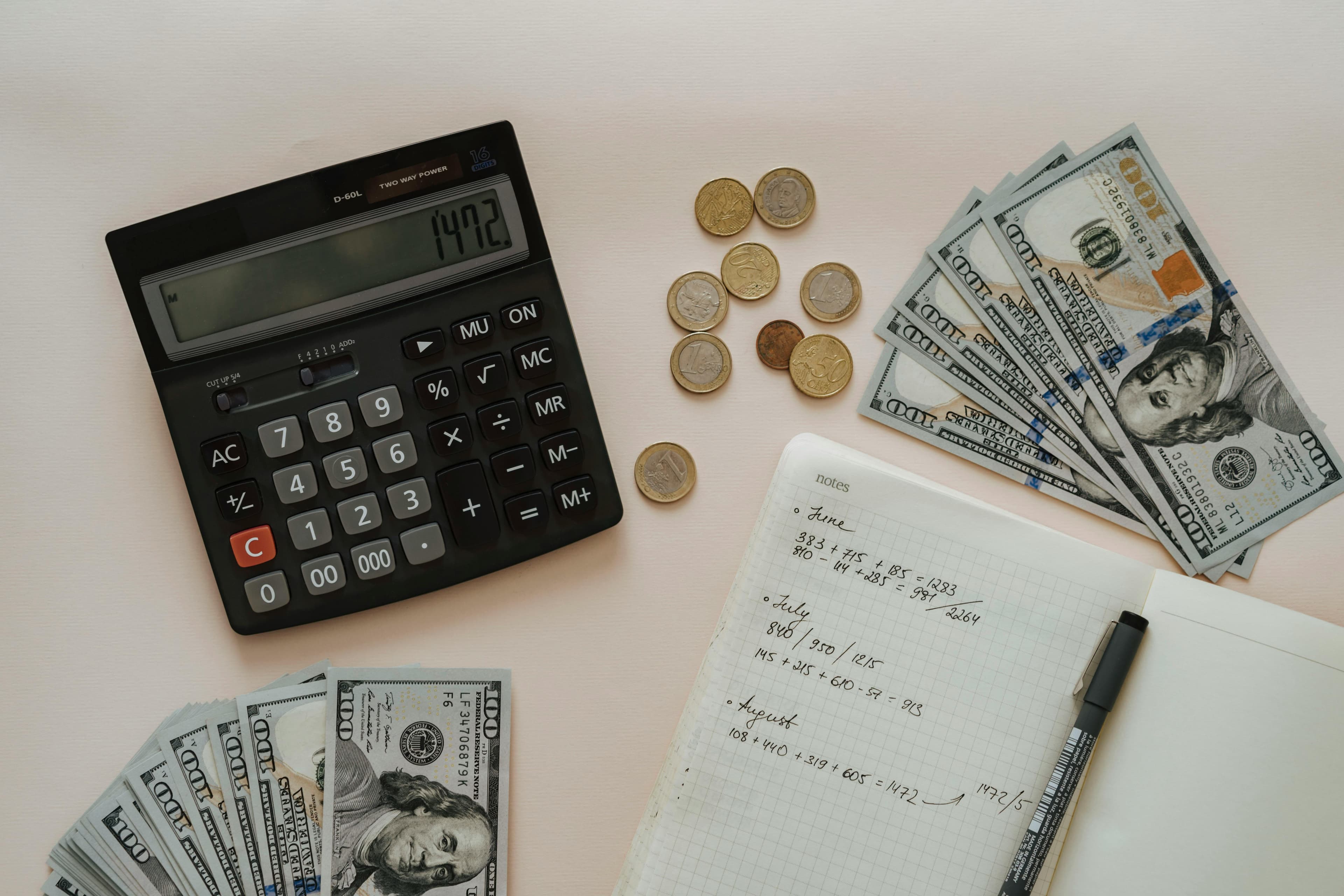

A rental property cash flow analysis is your financial X-ray. It shows you how profitable (or unprofitable) your property really is.

It looks beyond monthly rent and dives into:

By analyzing several months at a time, you see the true performance of a property. Without it, you’re flying blind.

At its simplest:

Cash flow = Income – Expenses

For rentals:

If income is higher, you’ve got positive cash flow—money in your pocket.

If expenses are higher, you’ve got negative cash flow—money bleeding out.

The math is simple, but the reality is nuanced.

Step 1: Calculate Gross Income

Add up every income source: rent, late fees, laundry, and application fees. better to be conservative and underestimate income than overestimate it.

Step 2: Estimate Operating Expenses

Taxes, insurance, utilities, property management, and maintenance. Always budget higher than expected. Emergencies happen; your math should prepare you for them.

Step 3: Find Net Operating Income (NOI)

NOI = Gross Income – Operating Expenses.

This is what lenders look at. If your NOI is strong, financing is easier.

Step 4: Subtract Mortgage Payments

The last step gives you true net cash flow—what you keep after everything. This is the number that decides if your investment feeds you or drains you.

Every property comes with costs that can surprise new investors. A smart cash flow analysis includes:

Leave one out, and you risk turning a “deal” into a disaster.

On average, rental properties generate 7–8% cash flow.

But averages don’t tell the whole story. What matters is your deal.

A simple benchmark:

But the bigger picture comes from cash-on-cash return.

Cash-on-cash = (Annual Cash Flow ÷ Total Investment).

If you invest $1,000 and earn $100/year, that’s a 10% return.

The industry standard of 10–12% is strong.

Why? Because stocks average 6–7% long-term. Real estate should beat that.

But don’t chase percentages alone. Look at both total profit and percentage return.

These help you spot potential deals fast but should never replace a full analysis.

Smart investors don’t just track numbers; they engineer better outcomes.

Little changes can add thousands in yearly profit.

Cash flow is the lifeblood of real estate. If you can calculate it, manage it, and grow it, you’re not just investing; you’re building freedom.

But here’s the catch: doing all this math, managing expenses, refinancing, and finding long-term tenants is complicated.

At W3Assets, we simplify the entire process.

You just buy your share, sit back, and collect rental income every quarter.

Real estate cash flow, simplified.

That’s freedom. That’s W3Assets.